Investing in the stock market comes with uncertainty, and market fluctuations can make it challenging to determine the best time to buy shares. Dollar cost averaging (DCA) is a strategy designed to reduce the impact of market volatility by investing a fixed amount of money at regular intervals, regardless of the stock price.

How Dollar Cost Averaging Works

Instead of attempting to time the market by buying shares at their lowest point, investors using DCA purchase stocks or exchange-traded funds (ETFs) systematically over time. This approach spreads the investment across different price points, which can help smooth out market fluctuations.

For example, an investor commits to investing $500 per month into a particular stock or ETF. Some months, the price may be high, leading to fewer shares being purchased, while in other months, when the price is lower, more shares are acquired for the same dollar amount. Over time, this results in an average purchase price that reflects both market highs and lows.

Benefits of Dollar Cost Averaging

- Reduces the Impact of Market Volatility – Since investments are spread over time, DCA helps mitigate the risk of making large purchases at unfavorable market prices.

- Encourages Consistent Investing – Setting up automatic investments ensures that an investor remains committed to their financial goals rather than making emotional decisions based on market movements.

- Eliminates the Need for Market Timing – Predicting market highs and lows is difficult, and DCA removes the pressure of trying to buy at the “perfect time.”

- Enhances Long-Term Portfolio Growth – By steadily accumulating shares over time, investors benefit from potential long-term appreciation and dividend reinvestment.

How DCA Affects a Stock Portfolio

- Lower Average Cost Per Share: Since the strategy involves buying both during market highs and lows, it can lead to a lower overall cost basis compared to making a single lump-sum purchase.

- Risk Reduction: Investing over time reduces the chances of investing a large sum right before a market downturn.

- Compounding Benefits: Over time, reinvested dividends and compounded growth can contribute to a portfolio’s value.

Dollar Cost Averaging vs. Lump-Sum Investing

While DCA offers a structured approach to investing, some investors prefer lump-sum investing, where they invest a large amount at once. Historically, lump-sum investing in a rising market may lead to higher returns since the money is invested earlier. However, for those concerned about market volatility, DCA provides a risk-managed alternative.

Dollar cost averaging is a widely used investment strategy that helps investors navigate market volatility by consistently investing over time. By removing the need to time the market, DCA can contribute to a disciplined and less stressful approach to building a stock portfolio. Whether used for individual stocks, ETFs from the ASX and US Stock Market, or other assets, this method supports long-term investing goals while reducing exposure to short-term price fluctuations.

All in all, dollar cost averaging can be an ‘easy’ way to put into an investment periodically, taking pressure off the entry.

Why Do People Dollar Cost Average

Dollar cost averaging takes the pressure off when it comes to getting the perfect price, they simply buy stocks at time intervals when they have their allocated money for that purpose, regardless of the price at the time. Of course, they could make an assessment to wait for a better price in the event the market is overvalued, but it isn’t a requirement.

Dollar cost averaging is mainly built to work on assets that will appreciate long term, so in a few years or more you are expecting that asset to rise in value compared to the current price, and the price over the coming 6 to 12 months.

When a stock has strong fundamentals, good long-term outlook and reason to expect the company and its macroeconomic environment to do well over the years, people are less worried about what price they get in now, in the expectation of their entry price being meaningless to a degree, comparative to the big picture.

Have Some Fun with Our Dollar Cost Average Calculator

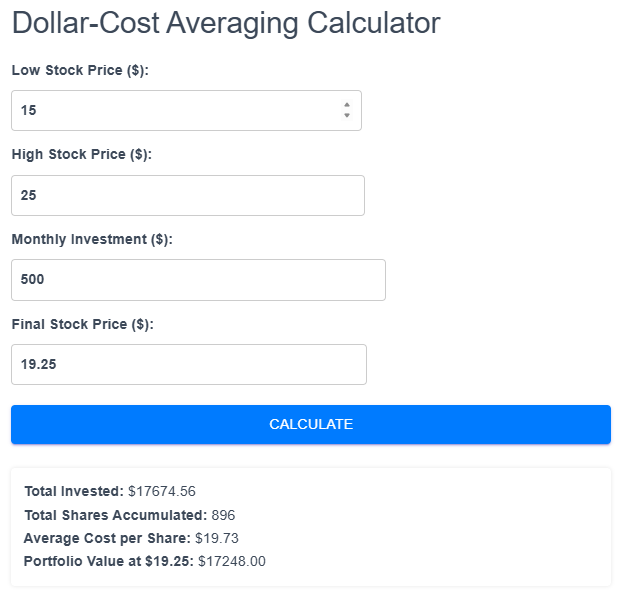

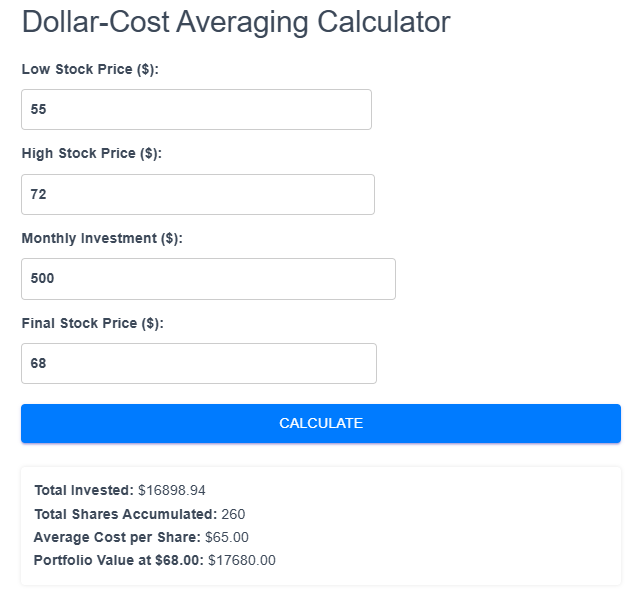

How it works:

Put in your expected final price, with an estimate of high and low price of a stock over 3 years.

Enter a monthly investment amount to dollar cost average over the 36 month period (3 years).

The calculator will randomise the average price and give you a rough idea of the end result based on your entries.

Here’s a few examples:

Note: The values are random, so take this concept with a grain of salt, and allow it to give you a feel for the way dollar cost averaging works over a 3 year period. It doesn’t take into account transaction fees, taxes, dividends or other events that may occur.

Dollar-Cost Averaging Calculator

Dollar Cost Averaging Takes the Edge Off

Unless you’re a hardened trader that loves assessing price, data and you have to have the best deal, dollar cost averaging is a way to take the edge off on your entry, putting more focus into the long-term bigger picture of your portfolio in the years to come.

Ready to Start Dollar Cost Averaging?

To access ASX and US stock markets with Macro Global Markets, open an account and gain access to all of the great benefits in the Members Area.

0 Comments