Let’s explore 10 long-only algorithmic trading strategies for stocks and how you can access automated systems for your share portfolio.

In today’s fast-moving stock market, traders who rely solely on gut instinct are being left behind. The future belongs to those who automate, and if you’re focused on long-only positions, there’s never been a better time to harness the power of algorithmic trading.

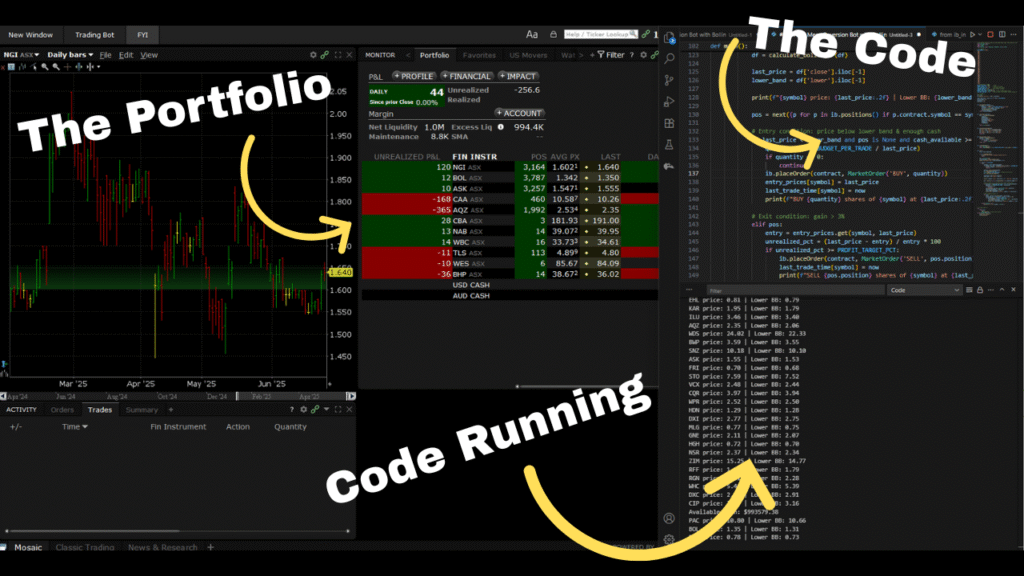

This guide reveals 10 powerful long-only strategies that stock algo traders are using to identify high-probability buy signals, from Bollinger Band dips to seasonal sector rotations. Whether you’re just starting out with Python or refining a portfolio of algos, these strategies are built to work with real-world data, clean execution, and sound logic.

Each method is backed by actionable logic, and we’ve included code examples, trade logic, and smart layering techniques to help you build and deploy them. You’ll also get access to bonus material, including our multi-condition seasonal framework, used by advanced traders to stay ahead of the market across all environments.

If you’re serious about levelling up your algo trading, this post is your blueprint. And if you’re ready to put your strategy into action, you can unlock all our frameworks and code packs by opening a live trading account with Macro Global Markets.

Let’s dive in.

Why Use Long-Only Algorithmic Strategies in the Stock Market?

Long-only algorithmic trading strategies for stocks are built on a simple but powerful concept: buy quality stocks and let time and momentum do the heavy lifting. In a market where over 80% of institutional investors rely on automation, retail traders are increasingly turning to long-only algos to stay competitive, without needing to short the market or predict crashes.

Here’s why long-only trading strategies are especially effective in the stock market:

1. Stocks Are Naturally Biased to Rise Over Time

Equity markets, particularly in countries like Australia (ASX) and the U.S. (NYSE/NASDAQ), show long-term upward trends. Central banks, earnings growth, and economic cycles drive stock prices higher over the years, giving long-only strategies a built-in edge.

2. Lower Complexity, Less Risk

Short-selling introduces margin risk, slippage, and overnight exposure. Long-only algorithmic trading strategies for stocks reduce that complexity, making them ideal for beginner algo traders and risk-managed investors like SMSFs or family offices.

3. Easier to Code, Test, and Optimize

Long-only algorithmic trading strategies for stocks are quicker to prototype in Python or platforms like Backtrader and QuantConnect. Without short logic, position reversals, or constant hedging, your strategies are simpler, cleaner, and easier to debug.

4. Aligns with Dividend and Growth Portfolios

Unlike short-term swing trading, long-only algorithmic trading strategies for stocks can be tailored to accumulate high-dividend or growth stocks, building long-term wealth with algorithmic precision. They’re perfect for investors looking to automate buy-and-hold logic with smarter timing.

5. Consistency with Seasonality and Trend Filters

Long-only algorithmic trading strategies for stocks can be layered with seasonal logic, trend filters, and fundamental screens to build robust systems. You can automate entries during bullish conditions and avoid sideways or declining markets, without overtrading.

If you’re looking to automate a stock strategy that aligns with the natural direction of the market, long-only algorithmic trading offers one of the most practical, scalable, and beginner-friendly pathways to do it.

🔒 Want to see how to automate these long-only algorithmic trading strategies for stocks with real-time data and Python code?

🎯 Join Macro Global Markets and access the tools, scripts, and training to build your first long-only algo, built for ASX and U.S. stocks.

How to Build a Stock Market Algorithm (Beginner-Friendly Overview)

Building a stock trading algorithm may sound technical, but with the right tools and structure, even beginners can create a fully functional trading bot. Whether you’re automating along-only algorithmic trading strategies for stocks or experimenting with technical indicators, the process follows a repeatable, step-by-step framework. If you’re just getting started, check out our Algorithmic Trading Guide for Beginners, it walks you through everything from setting up Python to running your first backtest using real stock data.

Here’s a beginner-friendly breakdown of how to build a stock market algorithm:

1. Define Your Strategy Logic

Start by identifying the conditions for entry and exit. For example:

- Buy when the price crosses above a moving average

- Exit when RSI reaches overbought territory

These rules become the core logic that your algorithm will follow.

2. Choose a Programming Language and Framework

For most beginners, Python is the go-to choice due to its simplicity and wide range of libraries. Popular algo trading frameworks include:

Backtrader(for backtesting and live trading)Pandas(for data manipulation)TA-Liborbt(for technical analysis)

3. Source Reliable Stock Market Data for your Long-Only Algorithmic Trading Strategies for Stocks

Algorithms need quality data to function. You can pull price data from Macro Global Markets paper trading account or:

- Yahoo Finance (via

yfinance) - Polygon.io or IEX Cloud

Always use clean, adjusted data to ensure your backtests are accurate.

4. Code the Strategy Logic

This is where you program your defined rules using if statements, indicators, and conditions. For example:

pythonCopyEditif price > sma_50 and rsi < 30: buy()

Use a backtesting engine like Backtrader to simulate how this logic would perform on historical data. Alternatively, you can run it in a live simulated environment to see how it runs in real time.

5. Backtest and Analyze Performance

Run your algorithm on past stock market data to evaluate performance metrics:

- Win rate

- Drawdown

- Risk-adjusted returns

- Max consecutive losses

Refine your parameters and rules based on test results. This is where data science meets trading edge.

6. Connect to a Broker and Automate Execution

Once validated, you can plug your algorithm into Macro Global Markets platform.

Make sure to paper trade before going live to catch bugs and optimize execution timing.

7. Monitor, Maintain, and Improve

Live trading is dynamic. Monitor logs, handle errors, and continue iterating. You can also add features like:

- Portfolio rebalancing

- Multi-strategy switching

- Seasonal or macroeconomic filters

Whether you’re automating a simple Bollinger Band buy strategy or building a full seasonal trading system, the journey from manual trader to algo trader starts here, with clear rules, clean code, and continuous testing. Long-Only Algorithmic Trading Strategies for Stocks isn’t completely set and forget, it’s critical to ensure your code runs as it should, long term.

Disclaimer – Before We Dive Into Strategy

The strategies, examples, and code snippets provided on this page are for educational and illustrative purposes only. They do not constitute personal advice, financial advice, investment recommendations, or trading signals.

Macro Global Markets does not guarantee the accuracy, completeness, or suitability of any strategy for your individual circumstances. All trading involves risk, and past performance of any strategy, whether simulated or actual, is not indicative of future results.

Before making any financial decisions or deploying automated trading strategies, you should consider your objectives, financial situation, and consult a licensed financial adviser if necessary.

This content is general in nature and intended for users who understand the risks involved in trading financial products.

And be sure to test any code before applying to a real market environment.

Strategy 1: Bollinger Band DCA – Buy the Dips

One of the simplest yet effective long-only algorithmic trading strategies for stocks is the Bollinger Band Dollar Cost Averaging (DCA) method. It combines the power of volatility-based technical indicators with a disciplined buying approach, perfect for traders who want to accumulate positions during price pullbacks.

📊 How It Works

Bollinger Bands are a volatility indicator made up of a moving average (typically 20-day SMA) and two bands plotted two standard deviations above and below the average. When the price touches or dips below the lower band, it often signals that the stock is oversold or undervalued in the short term.

In this strategy, we automate buying when the stock price dips below the lower Bollinger Band, allocating a portion of capital each time. This creates a natural DCA effect, averaging down the entry price while staying aligned with the long-term trend.

✅ Entry Condition Example:

- Price closes below the lower Bollinger Band

- Optional filter: RSI < 30 or Stock is in an overall uptrend

✅ Exit Condition Example:

- Price closes above the upper Bollinger Band

- OR use a trailing stop or target profit level

🧠 Why It Works

- Captures short-term overreactions in bullish stocks

- Avoids overtrading by only entering when volatility expands downward

- Builds positions systematically in strong long-term trends

🧪 Example Python Snippet:

pythonCopyEditif close_price < lower_band:

buy(size=capital_allocated * 0.25) # DCA entry

if close_price > upper_band:

exit_position()

This can be implemented using pandas, backtrader, or your preferred Python trading framework.

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Combine this strategy with a target stock list (based on fundamentals or sector strength) to increase quality. You can find this technique in Strategy #7 below.

By automating a DCA approach using Bollinger Bands, you’re building a smarter way to buy the dip, one of the most enduring tactics in long-only investing. When used with other long-only algorithmic trading strategies for stocks, it can form a core building block of a resilient, rules-based system.

🔧 Want the working code concepts to test for yourself?

🎯 Set up a trading account with Macro Global Markets and access a free algo trading consultation starter templates.

Strategy 2: Breakout Long – Buy the Breaks

Contrary to the classic “buy the dip” approach, this strategy taps into one of the most powerful forces in trading: momentum. The Breakout Long system is a core method in many successful long-only algorithmic trading strategies for stocks, especially for traders looking to ride strong trends as they form.

📊 How It Works:

This strategy triggers a buy order when the stock price breaks above its recent high, typically using the highest high of the past 20, 50, or 100 trading days. The logic is simple: when a stock makes a new high, especially with volume confirmation, it’s often the beginning of a strong upward move.

By buying with the strength, instead of waiting for a pullback, breakout strategies can capture explosive trends and reduce time spent in drawdown.

✅ Entry Condition Example:

- Close price > previous N-day high (e.g. 20-day high)

- Optional filter: Volume today > 1.5x average volume

- Optional filter: Stock is in an uptrend (e.g. SMA 50 > SMA 200)

✅ Exit Condition Example:

- Trailing stop-loss (e.g. 8–12%)

- OR close below a moving average

- OR a time-based exit (e.g. after 10 bars)

🧠 Why It Works:

- Momentum tends to continue, especially in strong growth or earnings-beating stocks

- Breakouts often trigger institutional buying or short-covering

- You avoid dead money zones (range-bound or downtrending stocks)

🧪 Example Python Snippet:

pythonCopyEditif close_price > highest_high(period=20):

buy(size=capital_allocated * 0.5)

if close_price < trailing_stop:

exit_position()

This can be implemented using backtrader, zipline, or Macro Global Market’s API.

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Use a volume filter to reduce false breakouts. Stocks that break out with strong volume have a significantly higher chance of follow-through.

The Breakout Long strategy is ideal for trending markets and growth stocks. When used alongside other long-only algorithmic trading strategies for stocks, such as Bollinger Band DCA or sector-based filters, it forms a robust system for catching high-momentum moves without needing to short.

🔍 Want to backtest this strategy on your favorite stocks?

📈 Sign up with Macro Global Markets to access our Python-ready tools, templates, and real-time execution framework.

Strategy 3: RSI Below MA – Ride the Uptrend

This strategy focuses on capturing momentum reversals within existing uptrends, making it a smart addition to your toolkit of long-only algorithmic trading strategies for stocks. By combining the Relative Strength Index (RSI) with a moving average trend filter, you create a system that buys temporary weakness in otherwise strong stocks.

📊 How It Works:

RSI is a momentum oscillator that measures recent price strength on a scale of 0 to 100. A reading below 30 suggests the stock is oversold, while above 70 signals it may be overbought.

This strategy looks for:

- RSI below a short-term moving average of RSI values (e.g., 5-day RSI vs. 14-day average)

- The stock must be in an overall uptrend (price > 50-day or 200-day MA)

You’re essentially buying into short-term weakness within a bullish trend, allowing for a higher-probability bounce.

✅ Entry Condition Example:

- RSI(5) < RSI(14) or RSI < 40

- Price above 50-day SMA (uptrend confirmation)

- Optional: MACD histogram turning positive

✅ Exit Condition Example:

- RSI crosses above 60–70

- OR price hits trailing stop

- OR price crosses below a moving average (trend breakdown)

🧠 Why It Works:

- Captures mean reversion opportunities inside established trends

- Avoids buying in sideways or bearish markets

- Offers cleaner signals than raw RSI oversold triggers

🧪 Example Python Snippet:

pythonCopyEditif rsi_5 < rsi_14 and close_price > sma_50:

buy(size=capital_allocated * 0.33)

if rsi_5 > 65:

exit_position()

You can calculate RSI using ta-lib or pandas_ta, and implement trade logic in Backtrader or QuantConnect.

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Pair this with volatility filters (like ATR bands) to ensure you’re not buying into chop or low-momentum ranges.

The RSI Below MA strategy is a clean, efficient method for catching trend-continuation pullbacks, an essential concept in any set of long-only algorithmic trading strategies for stocks. It works particularly well on tech stocks, ETFs, and growth leaders in trending markets.

⚙️ Want a training session on coding your own algo trading strategy?

📊 Open a live account with Macro Global Markets to access our RSI template and automated tools.

Strategy 4: Breach MA Long – Trend Confirmation Buy

When a stock breaks above a key moving average after trading below it, it often signals a shift in momentum. The Breach MA Long strategy captures this moment by entering long positions as price reclaims bullish territory, making it one of the most reliable long-only algorithmic trading strategies for stocks.

📊 How It Works:

This strategy waits for the stock to close above a chosen moving average, commonly the 50-day or 200-day, after spending time below it. This event suggests buyers are regaining control and a new uptrend may be forming.

You can use either:

- Simple Moving Average (SMA) – more stable and widely used

- Exponential Moving Average (EMA) – more responsive to recent price changes

✅ Entry Condition Example:

- Close > 50-day or 200-day MA, and

- Previous candle(s) were below that same MA

- Optional: Volume above 20-day average

✅ Exit Condition Example:

- Price closes below MA again

- OR fixed profit target (e.g. +8–10%)

- OR trailing stop loss

🧠 Why It Works:

- Filters out low-conviction sideways movement

- Focuses on trend confirmation, not prediction

- Reduces false signals during volatile ranges

- Helps capture the early stages of bullish trend reversals

🧪 Example Python Snippet:

pythonCopyEditif close_price > sma_50 and close_price_yesterday < sma_50:

buy(size=capital_allocated * 0.4)

if close_price < sma_50:

exit_position()

This strategy is easy to code using any data science stack (pandas, numpy) and can be backtested in backtrader or zipline.

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

For swing trading, use the 20-EMA; for position trading or longer-term setups, the 50 or 200 SMA gives cleaner, more reliable signals.

The Breach MA Long strategy is a powerful way to stay on the right side of momentum. When layered with other long-only signals, such as RSI confirmation or sector-based filtering, it becomes a core component of professional-grade long-only algorithmic trading strategies for stocks.

📈 Want a free algo trading coaching session?

⚙️ Set up your account with Macro Global Markets to unlock the testing engine and templates for moving average breakout systems.

Strategy 5: Volume Spike Entry – Momentum Buy Signal

Volume is the fuel behind price movement. A sudden surge in volume often signals that institutional players or large funds are entering a stock, and when paired with a breakout or technical pattern, it can lead to powerful follow-through. The Volume Spike Entry strategy is a momentum-based approach that fits perfectly into any portfolio of long-only algorithmic trading strategies for stocks.

📊 How It Works:

This strategy looks for unusually high trading volume relative to a stock’s recent history. When volume exceeds a threshold (e.g. 1.5x or 2x the 20-day average), it often indicates a shift in demand, either due to earnings surprises, news, or accumulation by large players.

Combine the spike in volume with a technical trigger, such as a price closing at a multi-day high, to increase reliability.

✅ Entry Condition Example:

- Current volume > 2 × average volume (20-day or 50-day)

- Price closes at a multi-day high (e.g. 10-day or 20-day high)

- Optional: Price above 50-day SMA (trend confirmation)

✅ Exit Condition Example:

- Price loses momentum (e.g. closes below 5-day EMA)

- RSI > 70 (overbought)

- Time-based exit (e.g. hold for 5 bars or 10 trading days)

🧠 Why It Works:

- Captures institutional demand and momentum spikes

- Confirms that price action is supported by real buying pressure

- Works well in trending or breakout markets

- Filters out false breakouts with low conviction

🧪 Example Python Snippet:

pythonCopyEditif volume_today > volume_avg_20 * 2 and close_price > highest_high(10):

buy(size=capital_allocated * 0.5)

if close_price < ema_5:

exit_position()

You can calculate average volume using pandas rolling windows or ta-lib, then structure the conditions using any Python-based backtesting engine.

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

For better outcomes, scan for volume spikes during earnings season, as this is when volume and volatility are naturally elevated, a prime opportunity for short-term long-only momentum trades.

The Volume Spike Entry strategy is ideal for active traders who want to capitalize on surges of buying activity. It’s a fast-moving tactic that adds offensive power to your lineup of long-only algorithmic trading strategies for stocks, especially when applied to growth names, ETFs, or event-driven setups.

📊 Want help screening for volume spikes on ASX and U.S. stocks automatically?

🔧 Clients of Macro Global Markets get access to templated volume scanners and real-time algo triggers.

Strategy 6: Open Outside Bollinger Bands – Reversion Entry

This strategy capitalizes on a lesser-known but powerful price behavior: when a stock opens significantly outside its Bollinger Bands, it often reverts back toward the mean, especially in trending markets. As part of your suite of long-only algorithmic trading strategies for stocks, this setup provides high-probability mean reversion entries with defined risk.

📊 How It Works:

Bollinger Bands dynamically adjust around price based on volatility. When a stock opens above the upper band or below the lower band, it’s typically considered overextended, often due to gap-ups on news or earnings.

This strategy enters long when price opens below the lower band, anticipating a snapback move. You can refine it further with filters like trend direction or volume contraction.

✅ Entry Condition Example:

- Opening price < lower Bollinger Band

- Optional: Previous close was inside the bands

- Optional: Trend filter (e.g. price > 50-day SMA)

✅ Exit Condition Example:

- Price reverts back to middle band (mean)

- OR fixed % profit target (e.g. +2–5%)

- OR time-based exit (e.g. after 2–3 bars)

🧠 Why It Works:

- Statistically, price rarely sustains movement outside the bands

- Gaps below the lower band often reverse intraday or within a few sessions

- Works well in low-volatility, mean-reverting environments

🧪 Example Python Snippet:

pythonCopyEditif open_price < lower_band and close_yesterday > lower_band:

buy(size=capital_allocated * 0.3)

if close_price >= mid_band:

exit_position()

You can calculate bands using pandas_ta or ta-lib, and backtest using backtrader or your platform of choice.

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Avoid stocks with major negative catalysts (e.g. bad earnings, regulatory issues), use a news filter to protect against buying into legitimate selloffs.

The Open Outside Bollinger Bands strategy is a sharp tool for exploiting emotional overreactions and price inefficiencies. It’s a smart complement to other long-only algorithmic trading strategies for stocks, especially when used on large-cap names or ETFs where price efficiency and reversion behavior are more consistent.

📉 Want to test this real-time strategy on ASX 50 and S&P 500 stocks?

🚀 Set up a Macro Global Markets account to access our templates, guides and testing framework.

Strategy 7: Target Market Selection + Strategy Layering (Python List Example)

While most algorithmic trading focuses purely on price action or indicators, some of the most effective long-only systems start before the chart, with stock selection. This strategy focuses on curating a list of fundamentally strong stocks and then layering technical strategies (like Bollinger Band DCA, RSI, or Breakouts) on top.

This approach ensures your algorithm isn’t just buying “signals”, it’s buying the right stocks at the right time.

📊 How It Works:

The idea is to pre-filter a watchlist of quality stocks based on:

- Fundamentals (earnings growth, return on equity, debt levels)

- Sector rotation (e.g. financials in Q1, retail in Q4)

- Institutional ownership or analyst upgrades

Once the list is prepared, you apply your technical algo strategies only to those stocks, increasing the probability of success.

✅ Step 1: Build a Target Stock List (Python Example)

pythonCopyEdittarget_stocks = ["AAPL", "MSFT", "CSL.AX", "WES.AX", "XRO.AX"]

This list can be generated manually from research, or automatically using APIs like:

- Yahoo Finance (via

yfinance) - Finviz (for US stocks)

- Morningstar or ASX feeds (for Australian stocks)

✅ Step 2: Apply Strategy Only to These Stocks

pythonCopyEditfor stock in target_stocks:

data = get_stock_data(stock)

if strategy_signal(data):

execute_trade(stock)

You can integrate any of the earlier strategies (e.g. RSI pullback, Breakout Long) into this loop.

🧠 Why It Works:

- Filters out low-quality, high-volatility stocks

- Focuses your capital on companies with upside potential

- Boosts technical strategy performance by combining it with sound fundamentals

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Build seasonal stock lists (see Strategy 10) for even more precise targeting, e.g., consumer stocks in Q4, energy stocks in Q2. You can then automate rotation between these lists throughout the year.

The Target Market + Strategy Layering approach brings a professional edge to your set of long-only algorithmic trading strategies for stocks. By using Python to manage lists and execute logic, you’re aligning your algo not just with technical signals, but with real-world investor demand and sector strength.

🧠 Want stock screener methods you can feed directly into your algorithm?

💼 Macro Global Markets clients get access to list methods, Python scripts, and sector-based stock rotation models.

Strategy 8: Exit at Upper Band – Profit Management Logic

Most traders obsess over entries, but it’s your exit strategy that often determines overall profitability. The Upper Band Exit approach uses Bollinger Bands, not just for identifying entry points, but as a profit-taking trigger. This makes it an essential layer in well-rounded long-only algorithmic trading strategies for stocks.

📊 How It Works:

When price reaches or exceeds the upper Bollinger Band, it often signals that the move is overextended, at least temporarily. Instead of holding through potential reversals, this strategy takes partial or full profits when that upper boundary is hit.

This doesn’t mean the trend is over, it just means it’s likely due for a pullback or consolidation, giving you a natural place to exit or reduce size.

✅ Exit Condition Example:

- Price closes above the upper Bollinger Band

- Optional: RSI > 70 (confirm overbought condition)

- Optional: Volume spike (potential exhaustion)

✅ Entry Logic Example:

This exit method can be layered onto any other long-only strategy:

- Bollinger Band DCA

- Breakout Long

- RSI Pullback

- Breach MA

🧪 Example Python Snippet:

pythonCopyEditif close_price > upper_band:

reduce_position(size=0.5) # Trim half the position

Or, to fully exit:

pythonCopyEditif close_price > upper_band and rsi > 70:

exit_position()

Use this in conjunction with your entry logic to create a full-cycle strategy.

🧠 Why It Works:

- Takes profits at statistically extreme price points

- Reduces emotional decision-making under euphoria

- Works well in ranging or choppy markets where full-trend follow-through is rare

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Instead of selling all at once, some traders use a scaling out method, e.g., sell 50% at the upper band, and hold the rest with a trailing stop. This can create balance between locking in profits while giving winners room to run.

The Upper Band Exit method is simple yet effective, especially when layered onto other long-only algorithmic trading strategies for stocks. It teaches discipline, preserves gains, and keeps your equity curve smooth in volatile conditions.

🔁 Want to test different exit logic methods across multiple strategies and stock groups?

📊 Join Macro Global Markets and access our exit-testing modules and templates.

Strategy 9: Portfolio Rotation – Value-Based Reallocation Logic

Even with the best entry and exit strategies, your performance can suffer if your capital is stuck in underperforming positions. The Portfolio Rotation strategy solves this by periodically reviewing your holdings and reallocating funds from overvalued or stale positions into higher-potential, undervalued stocks, all while staying long-only.

This is one of the most effective long-only algorithmic trading strategies for stocks when managing multiple positions across a broader portfolio (e.g., 10–30 stocks or ETFs).

📊 How It Works:

At regular intervals (e.g. weekly or monthly), your algorithm:

- Ranks portfolio holdings based on valuation, technical strength, or custom metrics

- Trims or exits positions that have become overextended or lagging

- Redirects capital into better-ranked opportunities from your target stock list

This keeps your portfolio dynamic, rotating into strength while harvesting gains from prior winners.

✅ Reallocation Criteria Examples:

- Sell stocks that:

- Are up >20% in 30 days

- Have RSI > 75

- Are underperforming the benchmark over 10 sessions

- Buy stocks that:

- Rank high on momentum or value screens

- Just triggered a signal from another strategy (e.g. Breakout Long or RSI Pullback)

- Are in sectors showing seasonal strength

🧪 Example Python Snippet:

pythonCopyEdit# Monthly rotation example

for stock in portfolio:

if stock.rsi > 75 or stock.return_30d > 0.20:

exit_position(stock)

for stock in target_stocks:

if strategy_signal(stock):

enter_position(stock, size=capital / len(target_stocks))

This framework allows your algorithm to actively manage capital allocation, not just individual trades.

🧠 Why It Works:

- Frees up capital from underperforming positions

- Rotates into stocks with higher upside or fresh technical signals

- Adds a systematic review process to reduce portfolio drag

- Encourages long-term compounding by trimming at strength and buying value

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Use sector weighting to guide rotation, e.g., cap tech exposure at 30%, or favor energy stocks in Q2. This adds another layer of risk control and seasonal opportunity.

The Portfolio Rotation strategy is like having a portfolio manager embedded inside your trading bot. It elevates your system from single-strategy trading to full-cycle capital management,and is a game-changer for serious users of long-only algorithmic trading strategies for stocks.

💼 Want to automate portfolio-level rebalancing and cross-strategy capital allocation?

📊 Macro Global Markets clients get access to rotational python concepts to test in real market conditions.

Strategy 10: Seasonal Sector Strength – Cyclical Outperformance

Markets don’t just move with charts, they move with seasons, earnings cycles, and macroeconomic flows. Certain sectors tend to outperform at more predictable times of the year, and this strategy taps into that edge. The Seasonal Sector Strength strategy uses a calendar-based rotation model to align long-only entries with the natural rhythms of the stock market.

When combined with technical triggers, it becomes a high-conviction, timing-enhanced system, and a must-have in your arsenal of long-only algorithmic trading strategies for stocks.

📊 How It Works:

The strategy begins by dividing the year into seasonal windows, typically quarterly or monthly. Each window is associated with sector-specific outperformance based on historical tendencies, such as:

- Q1: Financials, industrials (strong post-tax and fiscal flow)

- Q2: Energy, materials (resource demand uptick)

- Q3: Technology (growth trends & post-earnings momentum)

- Q4: Consumer discretionary, retail (holiday spending boom)

You then build target stock lists for each seasonal period and apply your favorite strategies (e.g., RSI pullback, breakout, volume spike) only to those sectors during their strong season.

✅ Entry Logic Example:

- If date is within seasonal window AND sector = “in-season”, scan for:

- Breakouts above 20-day high

- RSI pullbacks in uptrend

- Bollinger Band DCA signals

- Target only stocks in the strong sector list for that season

✅ Exit Logic Example:

- Price closes below trend filter (e.g., 50-day MA)

- End of seasonal window

- Position reaches predefined profit target

🧪 Example Python Snippet:

pythonCopyEditseasonal_sectors = {

"Q1": ["FIN", "IND"],

"Q2": ["ENE", "MAT"],

"Q3": ["TECH"],

"Q4": ["CONSUMER", "RETAIL"]

}

current_q = get_current_quarter()

for stock in universe:

if stock.sector in seasonal_sectors[current_q]:

if breakout_signal(stock):

enter_position(stock)

🧠 Why It Works:

- Aligns trades with institutional capital flows and macro cycles

- Filters out randomness by focusing only on stocks with seasonal tailwinds

- Combines fundamentals + timing + technicals into a cohesive system

- Helps rotate your capital across sectors throughout the year

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Backtest seasonal performance by sector using historical ETF data (e.g., XLF for financials, XLE for energy) to fine-tune your seasonal calendar.

The Seasonal Sector Strength strategy brings time-tested macro awareness into your trading bot. When layered with your existing setups, it helps you trade with the wind at your back, making your long-only algorithmic trading strategies for stocks both smarter and better timed.

📅 Want a full-season calendar and stock list generator for ASX and U.S. markets?

🔍 Clients of Macro Global Markets receive our seasonal screener guides + strategy overlay insights to help automate cyclical stock targeting.

BONUS Strategy: Market Condition Filters for Long-Only Systems

Markets are not always trending. They cycle through bullish surges, bearish corrections, and sideways consolidations. This bonus strategy gives you a major edge by allowing your algorithm to adapt its behavior based on current market conditions, while layering in seasonal stock selection for maximum precision.

Think of it as building a multi-strategy engine that intelligently decides when and what to trade. You wouldn’t dress for the snow when walking the desert, why should your strategies be coded for opposing market conditions.

📊 How It Works:

This system first classifies the current market condition using basic metrics such as:

- Price position relative to long-term moving averages (e.g. 200-day SMA)

- Volatility levels (e.g. ATR or VIX equivalents)

- Trend strength (ADX, MACD, or slope filters)

Once the regime is defined, your bot activates the most appropriate long-only strategy, then applies it to a seasonal stock list based on the time of year.

✅ Step 1: Define Market Conditions (Example)

pythonCopyEditif index_price > sma_200 and adx > 20:

market_regime = "bullish"

elif index_price < sma_200 and adx > 20:

market_regime = "bearish"

else:

market_regime = "stable"

✅ Step 2: Assign Strategies by Condition (Example)

pythonCopyEditstrategy_map = {

"bullish": breakout_long,

"bearish": rsi_pullback_on_strong_stocks,

"stable": bollinger_dca

}

✅ Step 3: Combine with Seasonal Stock Lists

Your bot selects stocks based on seasonal performance (see Strategy 10), then runs the appropriate strategy for current conditions:

pythonCopyEditfor stock in seasonal_stock_list[current_quarter]:

if strategy_map[market_regime](stock):

enter_position(stock)

🧠 Why It Works:

- Adapts your strategy to current conditions, helping to reduce drawdowns

- Applies long-only logic even in difficult environments by being selective

- Combines timing (seasonality), logic (strategy), and structure (regime)

- Allows you to run a portfolio of bots dynamically, with capital efficiency

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Add portfolio risk controls that reduce exposure when volatility is high or regime shifts are detected. This gives your system resilience across macro cycles.

The Conditions-Based Strategy + Seasonal Stock Layering model is what some professional quants use to manage multi-strategy funds. For solo algo traders, it could be the closest you’ll get to an adaptive edge, giving your long-only algorithmic trading strategies for stocks the intelligence to perform in bull markets, play defense in downtrends, and rotate effectively during sideways conditions.

🧠 Ready to automate market condition detection and multi-strategy switching in Python?

📊 Macro Global Markets clients get access to our condition-based algo templates and guides and seasonal model concepts, built for ASX and U.S. stock markets.

Example Python Code to Automate a Long-Only Strategy

Once you’ve chosen your entry and exit logic, the next step is bringing your strategy to life with code. Python is the most popular language for algorithmic trading, thanks to its simplicity, speed, and the massive ecosystem of trading libraries available.

Below is a basic example of how to automate a long-only trading strategy using Python, using a simple moving average crossover system as the core logic.

This framework can easily be adapted for other long-only algorithmic trading strategies for stocks, such as RSI pullbacks, breakout entries, or Bollinger Band reversions.

📦 Libraries You’ll Need

pythonCopyEditimport yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

💡 Sample Strategy: 50/200 SMA Crossover (Long-Only)

pythonCopyEdit# Step 1: Load stock data

data = yf.download("AAPL", start="2022-01-01", end="2024-01-01")

data["SMA_50"] = data["Close"].rolling(window=50).mean()

data["SMA_200"] = data["Close"].rolling(window=200).mean()

# Step 2: Define buy signals

data["Signal"] = 0

data.loc[data["SMA_50"] > data["SMA_200"], "Signal"] = 1 # Long-only condition

# Step 3: Simulate position holding

data["Position"] = data["Signal"].shift(1)

# Step 4: Calculate returns

data["Daily_Return"] = data["Close"].pct_change()

data["Strategy_Return"] = data["Daily_Return"] * data["Position"]

# Step 5: Plot equity curve

data[["Strategy_Return", "Daily_Return"]].cumsum().plot(figsize=(12,6))

plt.title("Long-Only SMA Crossover Strategy Performance")

plt.ylabel("Cumulative Returns")

plt.show()

🧠 What This Does:

- Only buys when the short-term trend (SMA 50) crosses above long-term trend (SMA 200)

- Never shorts or hedges, it’s a purely long-only approach

- Tracks daily returns and visualizes how the strategy performs over time

🧰 How to Extend This:

- Add filters like RSI, volume spikes, or seasonality

- Replace with Bollinger Band entries, breakout logic, or rebalancing modules

- Connect to Macro Global Markets for paper or real trading

This code is just a starting point. With a few adjustments, you can automate any of the long-only algorithmic trading strategies for stocks you’ve learned in this guide, from simple trend-following systems to dynamic multi-strategy models.

🧠 Want the complete Python strategy pack with modular code templates and backtest-ready data sets?

🔗 Open an account with Macro Global Markets to access our plug-and-play automation framework for long-only stock trading.

What Stocks Work Best for Long-Only Algo Trading?

Not all stocks are created equal, especially when you’re using long-only algorithmic trading strategies for stocks. The right stock selection can dramatically improve your win rate, reduce drawdowns, and make your algo trading more efficient and scalable.

Below are the key qualities to look for when choosing stocks for long-only algorithmic systems.

✅ 1. Uptrending or Growth-Oriented Stocks

Long-only algos work best in stocks that tend to go up over time. These might include stocks like:

- Tech leaders (e.g., AAPL, MSFT, XRO.AX)

- Growth stocks with strong fundamentals

- Stocks making new 52-week highs or breaking out of multi-month ranges

These stocks can provide clean momentum for breakout and trend-following strategies.

✅ 2. High Liquidity

When algo trading, you want stocks that can be entered and exited efficiently, especially if your strategy trades daily or intraday.

Look for:

- High average daily volume (at least 500K+ shares/day)

- Tight bid-ask spreads

- ASX 200 or S&P 500 constituents are ideal for stability

✅ 3. Low Volatility or Controlled Volatility

Long-only strategies can suffer in highly volatile or erratic stocks. Traders often aim for stocks with:

- Moderate daily ATR (average true range)

- Consistent trading ranges

- Less prone to major news-related spikes or gaps

This helps reduce stop-outs and false signals in mean-reversion or moving average-based strategies.

✅ 4. Sector Leaders

Top-performing stocks in strong sectors often outperform the market and can be more likely to sustain uptrends. Be sure to consider location and financial tax year timing when considering quarters.

Examples include:

- Financials in Q1

- Energy in Q2

- Tech in Q3

- Consumer discretionary in Q4

(See Strategy 10: Seasonal Sector Strength)

✅ 5. Fundamentally Strong Stocks

Even though you’re using technical signals, adding a basic fundamental filter can dramatically improve your results. Look for:

- Positive earnings growth

- High return on equity (ROE)

- Low debt-to-equity ratios

- High institutional ownership

⚠️ Stocks to Consider Avoiding:

- Penny stocks or microcaps with low volume

- News-driven biotech or speculative mining stocks

- Stocks with wide spreads or unpredictable trading behavior

🧠 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Create a dynamic universe of stocks based on filters like volume, volatility, and sector strength, then apply your long-only strategies only to those that meet your criteria.

You can automate this with Python using libraries like yfinance, pandas, or inside the Macro Global Markets trading platform.

By focusing on liquid, trend-friendly, and fundamentally solid stocks, you give your long-only algorithmic trading strategies for stocks potentially improved conditions to succeed, helping to improve trade quality and system stability over time.

📈 Want a python template for long-only algorithmic trading strategies for stocks on ASX and U.S. markets?

🧰 Get started with Macro Global Markets to access python templates and guides PLUS access to ASX and US equity markets.

How to Backtest and Optimize Your Long-Only Algorithmic Trading Strategies for Stocks, Before You Trade

Before risking real capital, it’s essential to validate your long-only algorithmic trading strategies for stocks through backtesting. This process helps you understand how your system would have performed historically, revealing its strengths, weaknesses, and areas for improvement.

Done correctly, backtesting can turn an idea into a statistically sound, risk-managed trading system.

✅ Step 1: Gather Accurate Historical Stock Data for your Long-Only Algorithmic Trading Strategies for Stocks

Use reliable, clean, and adjusted data to reflect real-world trading conditions.

Popular data sources:

yfinance(free and easy to use)- Polygon.io, Alpha Vantage, or Quandl for more precision

- ASX and U.S. market data providers (daily and intraday)

- Or use a paper trading account with Macro Global Markets

Make sure to adjust for dividends and splits to get realistic results.

✅ Step 2: Set Clear Entry and Exit Rules

Define your strategy logic in code:

- Entry: e.g., RSI < 30 and price above 200-day SMA

- Exit: e.g., price hits upper Bollinger Band or RSI > 70

- Risk: e.g., stop-loss at 5%, position size = 2% of portfolio

Example using Python:

pythonCopyEditif rsi < 30 and close > sma_200:

buy()

if rsi > 70:

exit_position()

✅ Step 3: Run Your Backtest

Use backtesting engines like:

Backtrader(Python-based, versatile)bt(lightweight portfolio-level testing)QuantConnect(cloud-based with live trading integration)

Track key performance metrics:

- CAGR (Compounded Annual Growth Rate)

- Max Drawdown

- Win rate & average trade return

- Sharpe Ratio / Sortino Ratio

- Trade frequency & exposure

✅ Step 4: Optimize Parameters (But Avoid Overfitting)

Try testing different values for:

- Lookback periods (e.g., RSI(10) vs. RSI(14))

- Stop-loss levels

- Indicator thresholds

- Entry/exit combinations

Use walk-forward testing or out-of-sample data to prevent curve-fitting, your strategy should be robust, not just lucky in hindsight.

✅ Step 5: Stress-Test Your Strategy

Simulate using our paper trading account:

- Slippage and commission costs

- Market shocks or flash crashes

- Strategy performance during sideways, bull, and bear regimes

This helps ensure your long-only algorithmic trading strategies for stocks remain stable across various market conditions.

🧠 Why Backtesting Matters:

- Confirms whether your long-only algorithmic trading strategies for stocks have a real edge

- Helps refine trade timing and capital allocation

- Builds confidence to execute live with discipline

- Prevents costly mistakes from live testing unproven logic

💡 Pro Tip – Long-Only Algorithmic Trading Strategies for Stocks

Backtest across multiple stocks and sectors, not just a single ticker. This increases statistical significance and reveals which types of stocks your strategy performs best on.

By rigorously testing and refining your ideas before going live, you’ll potentially improve the consistency, confidence, and long-term viability of your long-only algorithmic trading strategies for stocks.

🧪 Want Python templates and guides for ASX and U.S. stocks?

📊 Open a live account with Macro Global Markets and get full access to our paper trading account and real markets to run your long-only algorithmic trading strategies for stocks.

Start Trading with Macro Global Markets and Get Strategy Support

You’ve now seen how powerful long-only algorithmic trading strategies for stocks can be, from trend-following breakouts to seasonal stock rotations and regime-aware systems. But reading about strategy is just the beginning. To build, test, and execute these methods effectively, you need the right platform, data, and expert guidance.

That’s where Macro Global Markets comes in.

✅ Why Trade with Macro Global Markets?

🔧 Purpose-Built for Algorithmic Stock Traders

Our platform is designed for ASX and U.S. equity traders who want to automate strategies with Python, access fast execution, and avoid unnecessary complexity.

📚 Strategy Frameworks Ready to Test & Adjust

Get access to our complete library of python code templates, including Bollinger DCA, RSI pullbacks, breakout models, and dynamic portfolio reallocation code templates.

📊 Live Testing + Trade Simulators

Test your ideas in real-time using our data-connected Python environment and see how your strategy would perform across thousands of tickers and market conditions.

💬 1-on-1 Strategy Support + Automation Training

As a client, you’ll receive support from experienced algo developers and traders who can help you refine, scale, and automate your ideas with confidence.

🚀 Your Next Step for Long-Only Algorithmic Trading Strategies for Stocks

If you’re ready to stop guessing and start building real trading systems that compound over time, it’s time to go live.

🔗 Open your trading account today with Macro Global Markets and gain full access to:

- Python-based strategy templates

- Backtest-ready code examples

- Sector and seasonal stock screeners

- Step-by-step video training for beginners

- Priority support for setup, execution, and optimization

Whether you’re an ambitious DIY trader, a coder building a portfolio, or a performance-focused investor, Macro Global Markets gives you everything you need to launch and scale your long-only algorithmic trading strategies for stocks, the right way.

Let’s build your edge with long-only algorithmic trading strategies for stocks.

Frequently Asked Questions (FAQ) Long-Only Algorithmic Trading Strategies for Stocks

Q1: What are long-only algorithmic trading strategies for stocks?

Long-only algorithmic trading strategies for stocks involves buying assets (stocks) without shorting. It’s designed to profit when stock prices rise and is commonly used by investors who follow a bullish or value-driven outlook.

Q2: Can I automate stock strategies using Python?

Yes. Python is one of the most popular languages for algorithmic trading due to its powerful libraries like pandas, backtrader, and TA-Lib. You can use it to automate entry/exit logic, backtesting, and portfolio management.

Q3: Are these long-only algorithmic trading strategies for stocks suitable for beginners?

Absolutely. Many of the long-only algorithmic trading strategies for stocks in this guide are simple to implement and are designed for both beginner and intermediate algo traders. We’ve also included tips and code snippets to help you get started faster.

Q4: Do these strategies work on ASX stocks?

Yes. These long-only algorithmic trading strategies for stocks can be applied to both ASX and US stocks, as long as the data feed and broker API support your target market. Macro Global Markets supports ASX stock trading for clients.

Q5: How do I know if a strategy works before I risk money?

Always backtest your strategy using historical stock data and on a paper trading account with Macro Global Markets. This helps you understand its behavior across different market conditions. Tools like Backtrader, QuantConnect, or our Macro platform are ideal for this.

0 Comments