Macro Global Markets clients often ask a simple question: What are the best tools to research ASX stocks properly, without drowning in noise?

The reality is that “best” depends on your workflow. Serious ASX research usually needs four layers:

- Primary sources (announcements/filings straight from ASX)

- Screening & idea generation (filters, factor screens, peer comps)

- Decision support (valuations, research notes, report summaries, risk flags)

- Monitoring (alerts, watchlists, portfolio performance and reporting)

Below is a curated list of the best ASX stock research tools and research providers, organised so you can build a high-signal stack that matches how you invest.

General information only, not financial advice. Always verify key details against original ASX announcements and company reports.

Top picks at a glance

If you want a “fast shortlist” before the deep dive:

- Best for screening + valuation filters + AI report summaries: LTG GoldRock Stocks (Scanify + Stockify)

- Best free primary-source tool: ASX Announcements + ASX announcement search

- Best Australia-first market portal: Market Index

- Best “visual” research and quick triage: Simply Wall St

- Best independent research subscription: Morningstar Investor (AU)

- Best portfolio tracking (performance + dividends): Sharesight

- Best charting + alerts (technical workflow): TradingView

- Best “broker research, in one place” aggregator: Research Tree

How This List Was Selected

Each platform below earns its spot based on:

- Data credibility (primary-source where possible; reputable vendors elsewhere)

- Coverage depth (ASX breadth, small caps vs large caps, historical depth)

- Workflow fit (screen → validate → decide → monitor)

- Signal-to-noise (clarity, usability, alerting, exports/integrations)

- Value (what you get for the cost, if paid)

The Best ASX Stock Research Tools and Research Companies

1) LTG Gold Rock Stocks: Scanify (Stock Screener) + Stockify (AI Financial Report Analyser)

Best for: fast ASX screening plus plain-English summaries of long financial reports.

If you’re time-poor but want to keep research rigorous, this pairing is built specifically around two pain points:

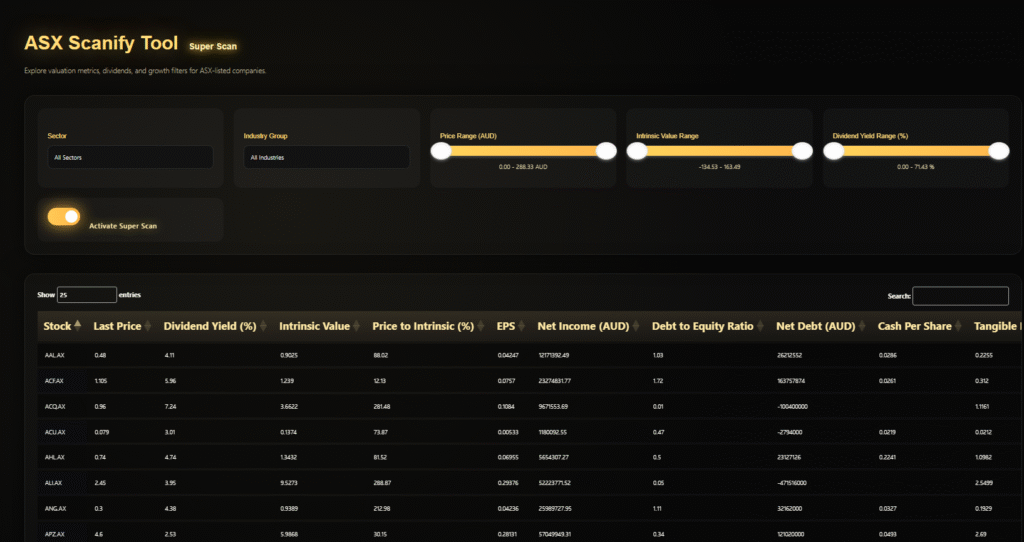

- Scanify is positioned as an ASX stock screener with intrinsic value filters, used to compare stocks on intrinsic value, earnings strength, and growth potential.

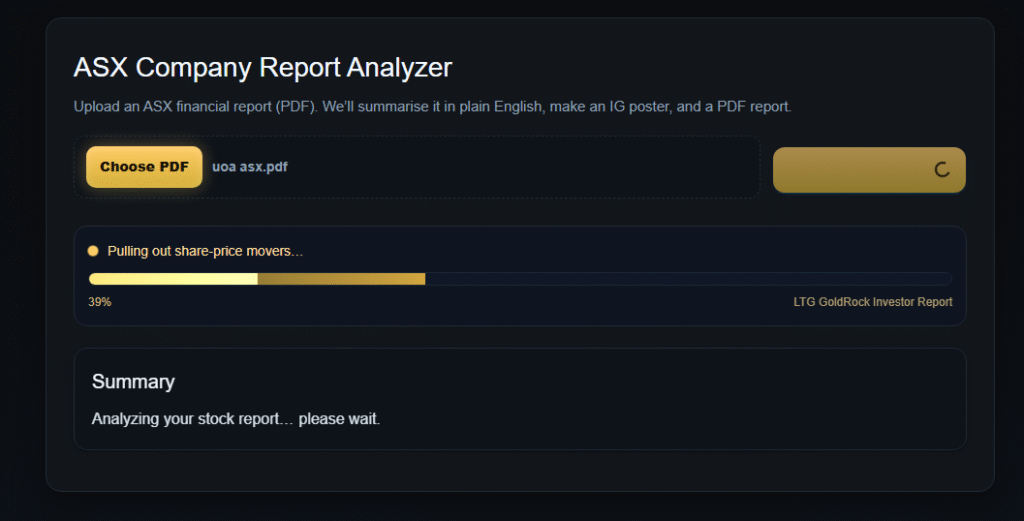

- Stockify is positioned as an AI stock report analyser for ASX annual & interim reports, summarising key drivers, valuation context, dividend outlook and risks in plain English.

Why it’s on this list

- It explicitly targets a real workflow: screen for candidates → then compress long reports into decision-ready summaries.

How to use it like a pro (and avoid AI traps)

- Use Scanify to get your shortlist.

- Use Stockify to accelerate comprehension, then cross-check any critical claims against the original PDF (especially segment numbers, guidance language, covenant/disclosure wording, and accounting policy changes).

AI tools are best used as “first-pass analysts,” not final arbiters.

2) ASX Announcements: the non-negotiable primary source

Best for: official, market-moving information (price-sensitive updates, results, capital raises, director changes, etc.)

Every serious research process starts here because this is the canonical source for ASX-listed company announcements.

- ASX publishes Today’s Announcements and allows searching recent/past announcements.

- ASX also provides access to historical announcements via its announcements search.

Use it for

- Confirming “what actually happened” vs headlines

- Reading the exact language management used

- Pulling original PDFs (appendices, presentations, full-year results packs)

This is a must use tool – the financial reports are like a blood test of the company, showing possible risks and where the company is in good health (or not). You can access the ASX here.

3) ASX Equity Research Scheme: free under-covered small-cap broker research

Best for: discovering research on smaller ASX companies that don’t get broad analyst coverage

ASX supports independent research on under-covered small caps via the Equity Research Scheme, and you can subscribe to receive weekly emails with links to reports received that week.

Why it matters

- Small caps can be information-sparse; this is one of the few structured sources of coverage without needing an institutional terminal.

Important limitation

- ASX notes there isn’t a browsable database, weekly email distribution is the primary access method.

4) Market Index: a clean, Australia-first market portal with scans

Best for: quick market context + simple idea generation without heavy tooling

Market Index positions itself as a portal for the Australian stock market with ASX market analysis, share prices, charts and index performance data.

It also offers “Scans”, predefined data filters designed to speed up research and idea generation.

Where it shines

- Fast sector/index context

- Quick scan-driven shortlists

- Easy-to-digest pages (good for daily workflow)

5) Simply Wall St: visual stock reports + fair value narratives + screeners

Best for: fast “triage” (understand the company quickly, spot obvious risks, move on or dig deeper)

Simply Wall St is designed to reduce market noise and provide visual in-depth stock reports, portfolio intelligence, and investing ideas.

Its plan comparison shows features such as portfolio tracking, fair value & narrative, stock notes/alerts, and limitations on screeners/reports depending on plan tier.

A useful transparency note: Simply Wall St indicates financial data is provided by S&P Global Market Intelligence (with analysis provided by Simply Wall St).

Best practice

- Use it for speed and structure, then validate key numbers and assumptions through announcements and company reports (ASX layer).

6) Morningstar Investor (Australia): deep independent research + screeners

Best for: investors who want analyst-backed research and valuations, not just raw data

Morningstar Investor’s AU pricing page lists 1 year at $675 and includes access to equity picks, screeners, and analyst research (among broader coverage).

Morningstar’s AU product page also notes that Morningstar Investor includes complimentary access to Sharesight’s Standard Plan (valued figure stated on the page).

Why it’s strong

- A structured research process that goes beyond surface-level ratios

- Works well as the “core research library” in a retail investor stack

7) Sharesight: portfolio performance, dividends, and reporting (the “truth serum”)

Best for: measuring whether your decisions actually worked (total return, income, CGT context)

Sharesight is widely used as a portfolio tracker; it offers a free starting tier (e.g., “track up to 10 holdings for free”) and paid upgrades for more holdings/features.

Sharesight’s AU pricing page also details business pricing for multiple portfolios (useful if you manage family structures or work professionally).

Why it’s essential even though it’s not a “screener”

- Most investors underestimate how much dividends, dilution, and timing impact real-world returns

- Good reporting reduces “story investing” and improves discipline

8) TradingView: charting, alerts, and screening for technical workflows

Best for: traders and technically-oriented investors who need robust charts + alerting

TradingView’s pricing/features page highlights paid-plan capabilities like more alerts, multiple charts per tab, and advanced indicator capacity (features vary by plan).

Where TradingView fits in an ASX workflow

- Use it after your fundamental shortlist (or as your initial momentum/price-action scan)

- Set alerts around earnings dates, breakouts, breakdowns, and key moving averages

- Combine with ASX announcements for “why did it move?”

9) Stock Doctor (Lincoln Indicators): rules-based ASX research + financial health framework

Best for: investors who want a systematic framework and evidence-based signals (buy/hold/sell style tooling)

Stock Doctor positions itself as an ASX share market research and analysis platform, with a complimentary 14-day membership (no credit card required per its site).

Lincoln Indicators also describes Stock Doctor as providing evidence-based insights based on quantifiable data analytics.

Pricing shown on Lincoln’s site includes a 1-year membership price and a promotional discounted price with an offer end date.

When it’s a great fit

- You want less discretion and more process

- You prefer “quality filters” before reading a single report

10) Stockradar: price-based analysis with a defined trading philosophy

Best for: investors who prioritise price action/trend process and want a long-running Australian provider

Stockradar describes itself as an Australian source of stock analysis and includes messaging around an education/investment philosophy and a focused trend-following strategy.

Practical note

- This is more “method + tooling” than a pure data terminal, so it’s best for investors aligned to that approach.

11) Research Tree: aggregated professional equity research reports

Best for: getting professional research notes in one place rather than hunting across the internet

Research Tree describes itself as aggregating professional equity research and stock reports, and also publishes platform stats (investor signups, provider count, research downloads).

Why it’s useful

- If you follow small/mid caps, research is fragmented; aggregators reduce friction

- Helpful for building “multiple viewpoints” into your process (not just one provider)

12) FNArena: independent market news and broker-driven insights

Best for: daily monitoring, broker angle summaries, and reporting season context

FNArena positions itself as a supplier of financial news, analysis and data services, and offers trial messaging.

It also publishes daily market reports and calendars (useful for staying on top of macro and results cadence).

FNArena also states it is not aligned with a financial institution and that its daily news is based more on updated views/insights from brokers and experts than on press releases.

13) Lonsec iRate: adviser-grade research, including ASX 200 equities

Best for: investors who want a professional research framework and risk ratings

Lonsec states that iRate includes qualitative research breadth, including ASX 200 equities (among other categories).

Lonsec’s equity research process description notes coverage of the ASX 200 and a model that differs from traditional buy/sell/hold approaches, focusing on risk ratings and “Approved/Not Approved.”

Where it fits

- Particularly useful if you value risk framing and consistency across a universe

14) Independent Investment Research (IIR): commissioned research distribution

Best for: accessing structured research on companies/products that may be under-covered (with clear disclosure expectations)

IIR states it specialises in analysis of commissioned research and notes it does not participate in corporate/capital raising activity (positioning around bias).

How to use it

- Treat as one input; still triangulate with primary disclosures and other independent sources

15) RaaS Research: small and micro-cap focused research house

Best for: small/micro-cap coverage and price discovery-oriented research

RaaS describes itself as an independent investment research house for small and micro-cap companies.

16) Pitt Street Research: issuer-sponsored small and mid-cap research

Best for: sector-specific small/mid cap research, often issuer-sponsored

Pitt Street Research states it provides issuer-sponsored research on ASX-listed small & mid caps and has an archive of ASX research reports by sector.

Investor caution

- Issuer-sponsored research can still be useful, but you should read disclosures carefully and verify key claims.

17) MarketScreener: global portal with ASX market pages, news, and analysis views

Best for: an additional “second screen” for quotes, headlines, technical/consensus-style views (depending on page)

MarketScreener’s AU portal describes quotes, news, charts, financials, technical analysis and more.

18) Institutional-grade platforms (for professionals and power users)

Best for: consensus estimates, transcripts, deep screening, Excel add-ins, ownership data, and enterprise workflows

These are typically expensive, but worth knowing about:

- Bloomberg Terminal: positioned as a tool for financial professionals needing real-time data, news, and analytics; Bloomberg also highlights research access from many sell-side/independent sources.

- LSEG Workspace: positioned as a workflow ecosystem of insights/news/analytics; LSEG also notes its Refinitiv brand consolidation under LSEG Data & Analytics.

- FactSet Workstation: positioned as all-in-one financial data software with real-time data and analytics.

- S&P Capital IQ Pro: positioned as comprehensive financial data + analytics + market intelligence, including earnings/consensus and “Document Intelligence” features.

If you’re not paying for one of these terminals, the “retail stack” (LTG + ASX + Market Index + Morningstar/Simply Wall St + Sharesight + TradingView) can still be extremely effective.

Best ASX Tool Stacks

Stack A: Free / low-cost fundamentals

- ASX Announcements (primary source)

- Market Index Scans (idea generation)

- TradingView (charting + alerts)

- Optional: Sharesight Free (track real returns)

Stack B: Fundamentals + “speed reading” financials

- LTG Gold Rock Stocks (Scanify + Stockalitics)

- ASX Announcements (verify source documents)

- Morningstar Investor (independent valuation/research layer)

- Sharesight (monitor outcomes)

Stack C: Small caps / under-covered names

- LTG Gold Rock Stocks Stockify AI Research Tool

- ASX Equity Research Scheme (weekly broker research links)

- Research Tree (aggregated research notes)

- FNArena (broker insight flow + reporting season monitoring)

A Repeatable ASX Research Workflow

- Start with reality: read the latest ASX announcements (don’t outsource truth to headlines).

- Screen intelligently: use valuation, quality and growth filters to build a shortlist (Scanify / Market Index scans / other screeners).

- Compress the paperwork: use an AI financial report analyser (like Stockalitics) to get a first-pass summary, then validate critical points in the report.

- Triangulate views: compare at least two perspectives (e.g., independent research + a portal summary + the primary report).

- Monitor: set alerts (TradingView) and track outcomes (Sharesight).

Of course, the final step in research is making a decision on which stock or stocks to purchase and taking action. If you are ready to buy stocks on the ASX or other markets, open an account and invest with Macro Global Markets.

FAQs

What is the best free ASX research tool?

The best free “must-have” is ASX Announcements, because it’s the official source for price-sensitive company disclosures and results documents.

What is the best ASX stock screener?

“Best” depends on how you invest. If you want valuation-led screening (including intrinsic value-type filtering) plus a workflow that ties screening to deeper document review, LTG GoldRock’s Scanify is built for that style of research.

Are AI annual report analysers worth it?

They can be worth it as a time-saving layer, especially to summarise key drivers, risks and financial highlights, but you should still verify critical details against the original ASX-released report.

0 Comments