Build Your Own Institutional-Grade Strategy with Macro Global Markets

Family offices today face an increasingly complex financial landscape. With growing market volatility, compressed margins, and heightened regulatory oversight, the traditional discretionary approach to portfolio management is giving way to more systematic, data-driven strategies. More than ever, sophisticated investors are recognising the value of algorithmic trading, not as a black-box hedge fund tool, but as a transparent, controlled, and custom-built system that aligns with long-term wealth preservation.

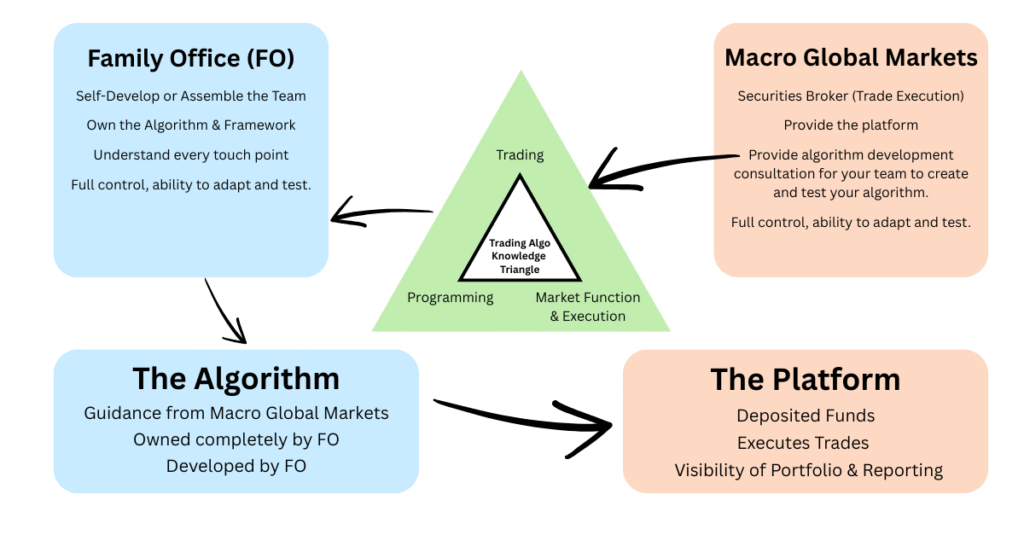

At Macro Global Markets, we work with family offices (FO) that want to own their algorithmic trading infrastructure. Our approach is grounded in transparency, education, and execution. This whitepaper outlines a professional roadmap to help you build and run your own algorithmic equity strategy.

This page is your gateway to accessing the full whitepaper, a guide crafted for principals, CIOs, and analysts within family offices who want more control, visibility, and confidence in their trading infrastructure.

Why Algorithmic Trading Now?

The investment world is evolving. Passive investing is no longer enough to preserve purchasing power. Discretionary trading struggles to keep up with real-time markets. And black-box external managers offer little visibility, high costs, and often, unpredictable outcomes.

Fund managers often charge significant fees without delivering consistent alpha. In contrast, algorithmic strategies, particularly those designed and controlled internally, offer repeatable processes that can be backtested, adjusted, and aligned with your office’s specific goals. While hedge funds and external quant managers offer sophistication, they often lack the transparency or cost-efficiency family offices seek today.

Algorithmic trading offers a path to:

- Execute repeatable, logic-based strategies that are visible to you and your team

- Control risk and exposure through systematic rules and planning

- Maintain operational visibility without relying on external fund managers

- Build internal expertise that can last generations

For family offices with long-term mandates, custom-built algorithms can serve as the backbone of a sustainable, rules-based investment process.

What’s Inside the Whitepaper

Retaining ownership of the algorithmic infrastructure ensures you don’t expose your intellectual property, data flow, or execution to third parties. We guide your team through setting up dedicated strategy environments using industry-standard tools hosted securely on your infrastructure or VPS provider.

Our comprehensive whitepaper delivers insights across five key areas:

1. Owning Your Infrastructure

Learn how family offices can build and retain full control of the algorithm and its execution, ensuring capital, data, and IP remain within your structure.

2. Designing Transparent Strategy Logic

Move beyond black-box models. We explain how to build clear, auditable logic using Python and Jupyter Notebooks, tools you or your analysts can use to understand and improve the system long term.

3. AFSL-Regulated Execution Framework

Operate through Macro Global Markets (AFSL 363972), with access to world-class execution technology via our trading platform. Stay compliant while retaining autonomy.

4. Training and Team Enablement

Whether your family office employs a CIO, analyst, or next-generation family member with an interest in trading, we provide the support and onboarding to help them gain skill and confidence in running the algorithm.

5. Building Long-Term Strategy Resilience

We explore methods to de-risk execution, manage drawdowns, and build logical layers for long-term capital preservation, using both tactical overlays and core allocation logic.

Who This Is For

This whitepaper is intended for:

- Principals and key decision-makers within family offices

- Analysts and CIOs seeking to improve in-house execution capability

- Families transitioning investment control to the next generation

- Consultants and advisers helping clients future-proof their portfolios

It is particularly relevant to family offices based in Australia or operating under Australian jurisdiction, but the methodology is applicable globally.

Why Macro Global Markets

At Macro Global Markets, we specialise in helping sophisticated investors take control of their trading systems. Here’s how we stand apart:

✅ AFSL-Regulated Execution-Only Model

We are licensed under AFSL 363972 and use an execution only model. That means you retain full discretion and control. We do not offer personal advice or manage capital, our role is to provide safe, transparent infrastructure.

✅ Client-Owned Technology

Unlike outsourced solutions or black-box quant funds, your strategy, logic, and data remain yours. You can edit, audit, and understand every part of it.

✅ Clear, Transparent Logic

All strategies are built using open, secure frameworks (Python, Jupyter Notebooks) and documented workflows. You can fully control every decision rule, stop loss, or condition inside the algorithm.

✅ Professional Training and Support

We help train your staff, whether in-house analysts, family members, or consultants, to understand strategy logic, platform setup, backtesting, and order execution.

✅ Neutral Infrastructure

Because we do not take positions or offer advice, our execution-only model eliminates conflicts of interest. You trade your strategy, your way, with our guidance only where required.

Download the Whitepaper

This whitepaper is free to download, no email wall, no lead capture, no obligation. We believe that thoughtful professionals deserve access to high-quality insights upfront.

If it resonates with your family office’s goals, we invite you to reach out for a confidential consultation.

Confidential Consultation Invitation

Developing an internal algorithmic capability doesn’t happen overnight. It requires time, planning, and thoughtful design. But with the right infrastructure and guidance, your family office can work towards build an enduring edge.

We offer:

- A confidential 1:1 discussion with our lead strategist

- A walkthrough of the development process and platform setup

- Clarity on the risks, responsibilities, and compliance boundaries

We only take on a small number of white-glove projects at a time to ensure full alignment and focus.

FAQ

Q: Is this a managed service?

A: No. This is an execution-only framework. You or your appointed representatives retain full control over every position and strategy rule.

Q: Do we need to know Python?

A: No prior coding is required. We provide templates, walkthroughs, and training. If your team has technical talent, we support them directly.

Q: What markets can we trade?

A: Our platform supports ASX and global equities, however many more stock markets are accessible if you desire.

Are you ready to take the next step?

You’ve spent years, decades, building a foundation for your family’s future. Now is the time to modernise the investment process while retaining what matters: privacy, control, and integrity.

If algorithmic execution aligns with your vision, we’d be honoured to support your journey.